Best of all, this procedure lets you pay people whether or not they’re also consumers at the lender. If you need to spend whilst you traveling or shop worldwide on the web, you may be better off having a smart account and you can credit. You can hold and you may create all those currencies in your account – all the from your portable – making actual and you may mobile payments together with your connected cards. Make purchases along with your debit credit, and you may financial from almost anywhere because of the cell phone, pill otherwise pc and most 15,100 ATMs and you may 5,100 branches. We’ve safeguarded the options if you want to make use of mobile phone within the an actual store. But what for those who only want to pay off your friend for lunch, or accept the new cable bill along with your roommates?

By paying on line instead of creating a check, the fee are canned easily. You might stop eventually paying the cash to your fee ahead of a check is actually eliminated. You always is set up continual payments through the power, rental, otherwise financial institution. Very businesses provide the option of joining an automated draft or arranged percentage. It’s always best to do an automated write only with expenses that will be constantly a similar each month. Establish automated repayments for your bills which can be an excellent place matter per month.

First released in britain by Barclaycard inside 2007, contactless payments features rocketed in the last 17 ages. Around a third of all the repayments in the united kingdom are in reality contactless, centered on United kingdom Finance, which have 87 percent of people and make contactless costs no less than monthly. By the end from this past year, contactless repayments taken into account 63 % of all charge card and you can 75 percent of all debit credit purchases.

Just install the newest software, check in utilizing your PayPal username and passwords or install an excellent the newest membership, and you will tap “Waiting for you” for the household screen. While it’s becoming more wide-bequeath every day, only a few locations deal with mobile wallets. The new app is free to make use of and simply has to be regarding the debit or charge card.

Ideas on how to Post and you may Do Fee Needs

If the cellular telephone is forgotten or stolen, instantly cut off your own notes on the app and make contact with the bank. Utilize the place or secluded rub have (Come across My personal new iphone, Bing See My Unit) to safeguard your own and you may economic study. To own pages searching for independence, some apps will let you put respect notes, plan out costs by class, as well as cut off notes with one to click whenever they position an excellent suspicious exchange. We feel blessed as acceptance to the our customers’ companies, so we try to render private services and you will personal cooperation throughout the your project.

- You will find which software pre-attached to all the Fruit’s latest items (which range from new iphone 4 six and later), the newest mobile phones try integrated with NFC technical.

- If you’d like to rating an update out of dated bucks and notes however’re new to app-centered repayments, remember that they’s safe and more straightforward to get install than you may imagine.

- When you’re using a third-party services, the process to own setting up repayments might possibly be similar.

- Note that past bullet section — this is when the smartphone solution comes in.

Really financial assistance for paying debts is offered from the mode away from subsidies to own specific expenditures https://playcasinoonline.ca/casigo-casino-review/ unlike in the dollars. However, you might be eligible for interests assistance to render bucks service. If you’re able to’t spend a charge card expenses, pose a question to your charge card team if they can give you a great crack on the commission terms. If you can show an intention to spend, they might leave you longer, straight down a cost, otherwise waive a charge. Beneath the Sensible Worry Work, medical insurance marketplace are created inside the for each and every county to help individuals contrast some other health insurance options. Such marketplaces will let you get the most costs-productive insurance to your requirements.

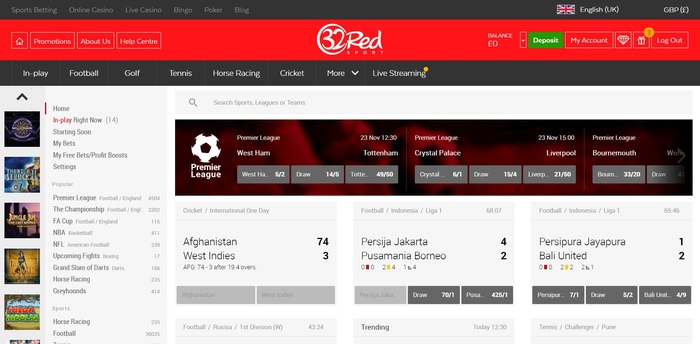

Right here, I’ll focus on the best possibilities to invest By Cellular phone. These also provides return a share of one’s casino losses returning to people since the bonus fund. For example, the newest gambling enterprise will keep tabs on your web losings a week otherwise day and will make you a certain percentage back as the a gambling establishment bonus. Concurrently, certain incentives wear’t require any put to claim.

Put products and associated characteristics are provided by the JPMorgan Pursue Financial, Letter.A great. Member FDIC. Chase on line lets you control your Chase profile, view comments, display pastime, make ends meet or import fund safely from main lay. To have questions or concerns, please get in touch with Pursue support service otherwise write to us regarding the Chase problems and you will opinions. View the Chase Neighborhood Reinvestment Operate Social File for the financial institution’s current CRA score and other CRA-relevant suggestions. To purchase a product on the internet, go to your shopping cart software to check out the newest Fruit Pay, Yahoo Shell out or other associated percentage symbolization and pick it your commission means.

Even if you are set, something like lengthened unemployment, a major illness, or a death on the family can certainly fatigue everything provides. Healthwell Foundation bridges the newest pit ranging from just what wellness insurancepays and the price of treatment and you may medications. They are able to assistance with health insurance premiums, deductibles, treatment co-pays, take a trip costs, and out-of-pouch costs. The new Supplemental Diet Assistance Program (SNAP) brings advantageous assets to help lowest-earnings family add more healthy meals on their shopping list. Breeze benefits are around for individuals one see certain money and you will works criteria and certainly will be applied to own on line.

When you fund a telephone, the expense of the machine is actually spread-over the duration of the fresh deal, and therefore increases your own payment. While you are prepared to explore an adult design, you can help save notably on your own monthly bill. To create it, unlock the brand new View application, faucet My Check out and choose Handbag & Fruit Spend.

Which place Samsung Shell out as the greatest to own Android profiles which have ten million profiles more Android Spend in the 2017 by yourself. Ever since Apple shined a white for the mobile money within the 2014 and that tip carries on development and obtaining big, with a brand new cellular payment app to see daily. Locating the best cards for this reason isn’t a simple task because the few personal handmade cards give an explicit perks class, as well as mobile costs. Interestingly, business handmade cards tend to give you the greatest rewards to own paying see monthly obligations such mobile phone services.

Medical insurance Opportunities

You’ll get confirmation of the pick right on the tool, and direct out of the store without contemplating starting their wallet. Most of us performed, because the debit cards made it simple to cover something without the need for a great fistful out of report debts. And debit notes generated cash a good relic from ages gone by, mobile phones are actually performing the same in order to vinyl. From inside the fresh software you can view your bank account harmony, monitor the playing cards, deposit monitors if you take an image, establish alerts and also have the new position on the borrowing from the bank get. After you’ve added an installment strategy in the Fb you are willing to store, build a contribution or send money to you aren’t a twitter account and you will a linked debit credit.

Fruit Shell out

If you wear’t need to is an affixed invoice, only show the fresh charge matter—or any kind of details a buyers may need to spend the expenses online—in your body of one’s text message. In both this informative guide along with the new insane, you’ll find text-to-shell out also known as “Sms costs,” “Sms costs spend,” “pay from the text,” “Texts collections,” or other variations. Get together costs from the text message is one of the surest a means to improve cashflow and create better customer knowledge. SoFi Checking and you will Deals is a great membership solution for many who usually do not notice keeping your offers and you will examining in one single account. Which have on the internet expenses pay, you won’t need to worry about post waits otherwise anyone taking the view.

Rather than NFC on the cellular phone, you won’t be able to generate contactless payments in shops, although there are other cellular fee choices you to definitely we are going to talk about later on. You just make use of your cellular telephone’s digital camera to add your respect otherwise current cards too while the handmade cards. When they’lso are piled, you can check out nearly everywhere credit or debit notes is actually recognized. If you link Venmo along with your debit card otherwise family savings, all of the transmits are entirely 100 percent free. That have credit cards indeed there’s an excellent step 3% fee to deliver money so you can family and friends (choosing is free), but not you to definitely fee try waived once you purchase from a corporate. Focusing on how to make use of the charge card on your mobile phone is create shopping more convenient and keep you against needing to build contact with the brand new cards critical.