Usually Educational funding award packages are not sufficient to protection new complete costs. When this happens there are many more choice and you can urban centers to appear during the to have let!(Excite get in touch with Financial aid Functions for more information and you can assistance if necessary toward mortgage issues)

When obtaining most money, making an application for the full seasons (loan several months ount might be separated between Slide and Springtime evenly. For folks who simply want a session financing be sure the loan months is the fact sorts of semester (Aug so you’re able to Dec Or The month of january to May Or Could possibly get so you can Aug). Accommodate about two weeks, regarding finally acceptance condition, for some funds to display as Pending towards the membership otherwise expenses.

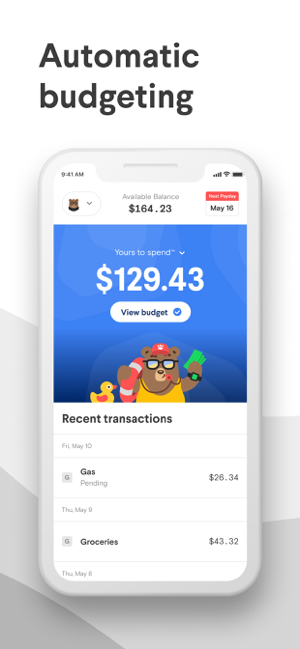

Estimating financing or payment bundle requires ahead of recharging features happened is actually effortless with this particular equipment! Assist our office determine if you desire even more let!

Parent And additionally Financing

New father or mother logs to the using their individual FSA ID and you may code. Around Father or mother Individuals click on Make an application for a plus loan. In case the parent is actually:

- Recognized – they then need certainly to finish the Master Along with Promissory Note

- Denied – the new pupil ount out of unsub Stafford Funds in their label. ($4,one hundred thousand to the year – dos,one hundred thousand slip and 2,one hundred thousand springtime – reduced origination costs).

Add up to make an application for – there was a keen origination commission withheld from the finance because of the servicer, just before disbursement to the college. So it count is roughly cuatro.228%. Such as for example, should your And additionally loan is actually for just one, – the web based amount to disburse (post) to your college students account do just be . If you need 1, to share towards the children account, the borrowed funds software number would be step 1,.

- The quantity should be left blank purposefully. This would allow the financing to be the most anticipate into the semester and you will year – if it exceeds your position please reduce the mortgage just before disbursement. The borrowed funds transform means is on Financial Aid’s webpages.

- This isnt open to people that are considered separate from the Financial aid

- New pupil Must be and work out educational funding advances (minimum collective GPA dos.0 and you may % conclusion price) for government services and additionally Parent Plus loans. If a student isnt progressing for Stafford Funds they cannot discovered Mother or father Along with fund.

- Scholar have to be taking six loans or maybe more to use federal services including Mother or father Also money.

Choice Money

Speaking of money a student consumes the name which they need to pay back, nonetheless they you need a cards-worthwhile co-signer. Comment lenders, their interest pricing thereby applying all the on one webpages elmselect. There are lots of Mother Option Fund offered.

- Nj-new jersey Customers Merely – here are a few to own Nj-new jersey Category Fund – scholar otherwise parent loans which have high rates of interest!

- PA, Nj-new jersey, Nyc, MD OH Citizens Merely – here are some to own PA Send Funds – beginner or father or mother financing with great interest rates!

- Zero origination costs to adopt for some option financing, except Nj Category money who’s got about a step 3% origination https://www.speedycashloan.net/loans/loans-by-phone/ fee (subject to changes).

Payment Agreements

Glance at our web site having information on how, when and where to join up! The sooner you sign up, the better the master plan! Questions regarding fee plans will be directed to focus from Student Levels.

Warning! Never Use more you desire!

We want all children are smart consumers and just simply take loans which they it really is need to pay its costs associated with college or university. If you find that financing, otherwise your parent’s fund, be much more than just requisite, you can lose people loans Ahead of they disburse to cease over-borrowing from the bank and you may reducing the debt abreast of graduation. Remember, we’re going to perhaps not beat financing or cancel that loan as opposed to a done mode (except for directions from the bank or if you withdraw regarding semester or KU).

Go to the School funding page Versions and complete the Student loan alter function in the event the mortgage try a student loan Otherwise finish the Mother mortgage alter form in the event your loan is a good mother mortgage.