He’s generally speaking reduced by the condominium owners and other homeowners of a well planned urban creativity (PUD) or town household. He or she is repaid on monthly basis, semi-per year or per year. These are paid on their own so you can administration team otherwise an overseeing human body for the association. HOA expenses cover up functions including lift repairs, repair, surroundings and you may court costs for owners together with clients.

Its a payment per month paid by the resident with the work with of one’s bank. Its smart call at question of standard. Financial gets payments. It is insured getting old-fashioned financing courtesy Federal national mortgage association and Freddie Mac in which down payment out of 20% or quicker is required. This financial insurance is dubbed just like the Private Home loan Insurance (PMI). With FHA and you may USDA money, financial insurance is called because the Home loan Insurance costs (MIP). Sometimes it is reduced upfront (UFMIP) otherwise just like the one-superior. It’s very possibly financial-paid off (LPMI).

They’re figuratively speaking, auto accommodations, automotive loans, alimony repayments and you may guy support, bank card money and you can cost loans

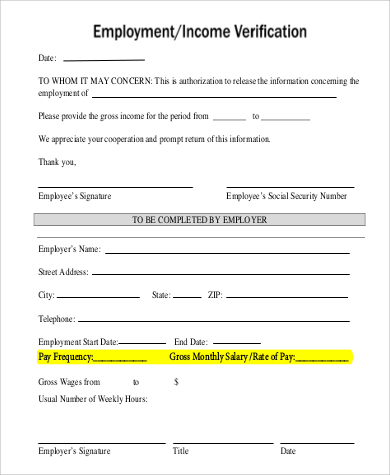

It’s the level of recorded income that you earn for each season. Earnings is acquired in the forms of retirement, son support, W-2 earnings, social safety money, K-1 withdrawals and you may alimony. Non-claimed earnings can not be employed for qualifying intentions on a home loan. Always utilize pre-income tax earnings if you are having fun with a mortgage commission calculator.

These are continual repayments which might be due to be paid month-to-month. Something to become detailed is the fact the month-to-month mastercard percentage is the minimal due commission rather than your own full balance owed. To possess credit cards who has no due fee delight fool around with 5% of harmony owed as your minimal due payment.

Dominating installment increases month-to-month up until the loan is actually paid-in complete

Its a loan provider term that is used to sort out someone’s house affordability. Its calculated by breaking up the sum of the your own monthly bills on the proven month-to-month money. Essentially, mortgage approvals demand a forty five% debt-to-money ratio otherwise faster. Discover exceptions too. A good forty-five% DTI is not a good idea. It does place your primary money towards homes money.

It’s the monthly responsibility on the family. It offers their homeloan payment including citizen association dues (HOA) where he is relevant. Monthly payment may differ over time given that its section will vary. Real estate goverment tax bill also alter on the yearly foundation thus does the brand new premium on the citizen insurance policies. Residents that obtained a varying speed mortgage can get one the mortgage payment may differ throughout the years pursuing the very first fixed period toward loan ends up.

It is the agenda considering hence a mortgage is paid off to help you a financial. It may differ as per loan title. A thirty-12 months mortgage will receive another pace than simply good fifteen otherwise 31 12 months you have. In the earlier age, antique amortization times put high level percentage from mortgage desire along that have a decreased percentage of prominent installment. In brand new senior years, home loan rate of interest percentage plummets and you will principal cost percentage goes payday loan Cathedral up. Particularly, during the the current financial costs, whenever we look at the first year out of a loan, an effective fifteen year home loan possess 38% attract and you can 62% dominating while you are a thirty 12 months financial has 72% desire and 28% principal. The latter will meet ratio not in advance of than its 18 th 12 months.

It will be the amount that is lent regarding a bank upcoming it is paid on bank per month as part of mortgage repayment. The mortgage label is generally fifteen, 20 or three decades. Typical monthly obligations boost your collateral on such basis as presumption that the house’s worth has never altered. However, if value of your home falls, equity percentage minimizes in place of loss in the loan’s harmony. Also when the worth of your house increases, their guarantee percentage have a tendency to increase by a price that is larger than your own payment for the prominent.