Posts

The newest Dragon Connect slot machine lender can be produced right up out of varying numbers of servers, blended anywhere between four additional titles. The brand new included games is actually Panda Wonders, Fantastic Century, Delighted & Successful, and Fall Moon. Each of these headings spends a classic four reel, 5×3 setup, that have twenty five so you can 50 paylines on every twist. The newest game fool around with relatively white theming, but it’s nonetheless easy to tell them apart from both.

Seasons online slot – Are there any incentive online game within the 5 Dragons?

Having several modern jackpots and you will fun extra have, your future big win would be only a spin aside. Tim are a professional pro inside the casinos on the internet and you can ports, having several years of hand-on the experience. Their within the-breadth degree and sharp expertise provide professionals trusted analysis, enabling them come across finest video game and you will casinos to your ultimate gaming experience. The brand new dragon harbors appear in all online casino and lots of real-lifetime gambling enterprises around the world. Of numerous local casino other sites features a wide range of dragon-themed video game. There are fun and you may colourful harbors including A Dragon’s Tale otherwise a realistic and you may horrifying game such as Dragon’s Inferno.

The online game has high volatility, an excellent 96.5% RTP, and you can a maximum winnings out of 20,000x your own bet. Sugar Rush are an exciting chocolate-styled position from Pragmatic Enjoy, create inside 2022. It uses an excellent 7×7 grid and you may a cluster pays system, where you winnings because of the getting 5 or maybe more matching icons touching one another.

Kind of Slot Game

Starlight Princess are a well-known comic strip-design slot from Pragmatic Play, released inside 2021. They provides a good 6×5 grid and spends an excellent “Spend Anyplace” system, in which victories are from 8 or higher matching icons everywhere for the the newest monitor. The overall game features high volatility, a great 96.5% RTP, and will be offering an optimum winnings of 5,000x your bet.

Similar Games

A world of fascinating harbors and also the chance to winnings real money awaits you. Dragonz 2 are a video slot away from Hammertime Studios featuring 5 reels and you may step 3 rows that have 243 a means to winnings. The Seasons online slot video game includes an enthusiastic RTP out of 96.30% and it has high volatility, providing a thrilling experience in a good max win away from 15,000X the fresh choice. Have fun with the Dragons Chance on the internet position and you can hit around three coordinating signs to help you earn a reward.

They have a tendency as practical pets, far more similar to gods than just mythical beasts, delivering chance and you may precipitation and impacting anyone’s lifestyle. If you go back ages, this is basically the more conventional treatment for view dragons – since the icon serpent-such animals with elaborate whiskers and you may bright colour. It’s likely that, if you reside from the Western when you think about Dragons, you’ve got a very clear picture.

- It 100 percent free Aristocrat games provides a range of oriental-driven signs and dragons, koi, tigers and statues along with other unrelated signs for example the new cards symbols A, K and Q.

- For those who have the ability to fill the complete grid, you’ll open the most winnings potential as much as 10,000x your own share.

- All of our best web based casinos make a huge number of professionals happier everyday.

- Produced by ReelPlay, the fresh infinity reels element adds a lot more reels on each win and you may goes on up to there aren’t any much more wins inside the a slot.

- Read on that it 100 percent free self-help guide to find my personal best five dragon position game designed for online.

Left of your own reels, five colorful dragons sit with pride, for each representing one of many exciting jackpots. The game are followed by adventurous sounds you to definitely brings your deeper to your realm of Dragonz. Play Dragons Chance the real deal money during the many of the best online casinos.

- They through the classic lineup out of casino games, plus they allow you to lay wagers to your mainstream games such since the Dota 2, Group away from Tales, Counter-Strike, eTennis, and a lot more.

- They are able to travel, inhale flames, and check such as giant lizards who’ll joyfully eat you inside the you to definitely bite.

- While you are inquiring so it concern, it is definitely worth seeking each other aside, in addition to personal casinos such 7 Oceans, or Las vegas World.

- For example, Flint, the newest purple fire-respiration dragon, brings Flaming Wilds, igniting the new reels for additional perks.

- You could potentially enjoy over three hundred online slots entirely, as well as a lot of higher RTP game and you can modern jackpot ports, along with claim a $3,000 invited incentive.

Explaining 5 Dragons Slot machine game

It has a good 5-reel, 3-line style which have ten paylines and provides medium so you can large volatility. Sure, you could potentially enjoy Dragon Slots Local casino right from the cellular telephone otherwise tablet. This site work in just about any cellular internet browser, generally there’s no need to down load some thing. Because of this, it’s easy to diving to your a casino game wherever your are.

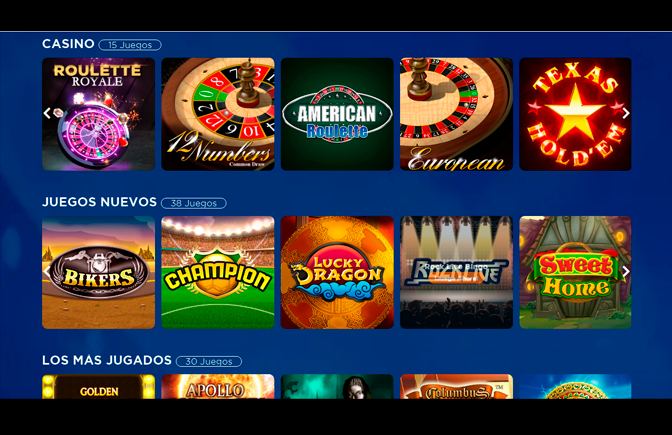

While the a leading on-line casino, Dragon Slots features a plethora of app team in betting positions. Out of Microgaming, Nextgen, and you will NetEnt playing’n Go, WMS, and you may Yggdrasil, you will find the brand new heavy hitters of your own iGaming globe to your the site. Your website have large-high quality and you can common headings for example Book of your Irish, Magic of Pandora, Quirky Panda, Wild Orient, The newest Better Reels from Life, and more.

On the other, they are the deal with out of dream eras within this all the culture across the the world. From medieval The united kingdomt for the Asia, folklore and fairy stories always make room for dragon protagonists. This summarizes as to the reasons dragon slots on the internet has such an excellent grand pursuing the. Away that have antique paylines, Microgaming also offers professionals 243 some other paths in order to earn, aiming for an even more dynamic game play feel. Even though it may seem guaranteeing, making certain a victory with each spin, the fact is quicker quick. However it shocked all of us whenever we already been writing so it checklist to see exactly how many online slots having Dragons you can find and you may exactly how well-known it’ve end up being to own professionals around the world.

Should your free revolves are triggered again, you will need to choose again. The options were 15 totally free spins that have multipliers of five, 8 or 10x. After ten 100 percent free revolves, you could retry and you will hope for multipliers as big as 30x. You could correspond with him or her thanks to real time chat (responses in less than 2 moments), email, otherwise look at the Help Center that have effortless guides and you will common inquiries. Unlike additional gambling enterprises, right here you earn brief and you may friendly let at any hour. The employees chat clear English and establish some thing in a sense that’s easy to follow.

The platform brings a keen immersive playing sense because of the connecting people so you can alive buyers. Slots are the newest wade-in order to choice for multiple people, also it’s a bit readable, as these online game need no earlier experience. When you’re one of for example players, you’lso are set for an excellent enlarge go out during the Dragon Slots, as the on line program has an extraordinary type of slot online game. A similar symbol try a good spread symbol, awarding totally free spins if this places on the middle around three reels of your River Dragons slots video game immediately. An elementary eight bonus online game enjoy aside, but this really is increased from the number of scatters one got on every reel on the leading to twist.

Sweepstakes come in the us, although not many other countries. Unlike games including online craps, position game wear’t you would like any approach. Such as video poker, you need to use autoplay in order to spin the newest reels automatically.