Tips

- Switching services brings circumstances whenever getting home financing should your debtor is highly leveraged or plans to use a little put.

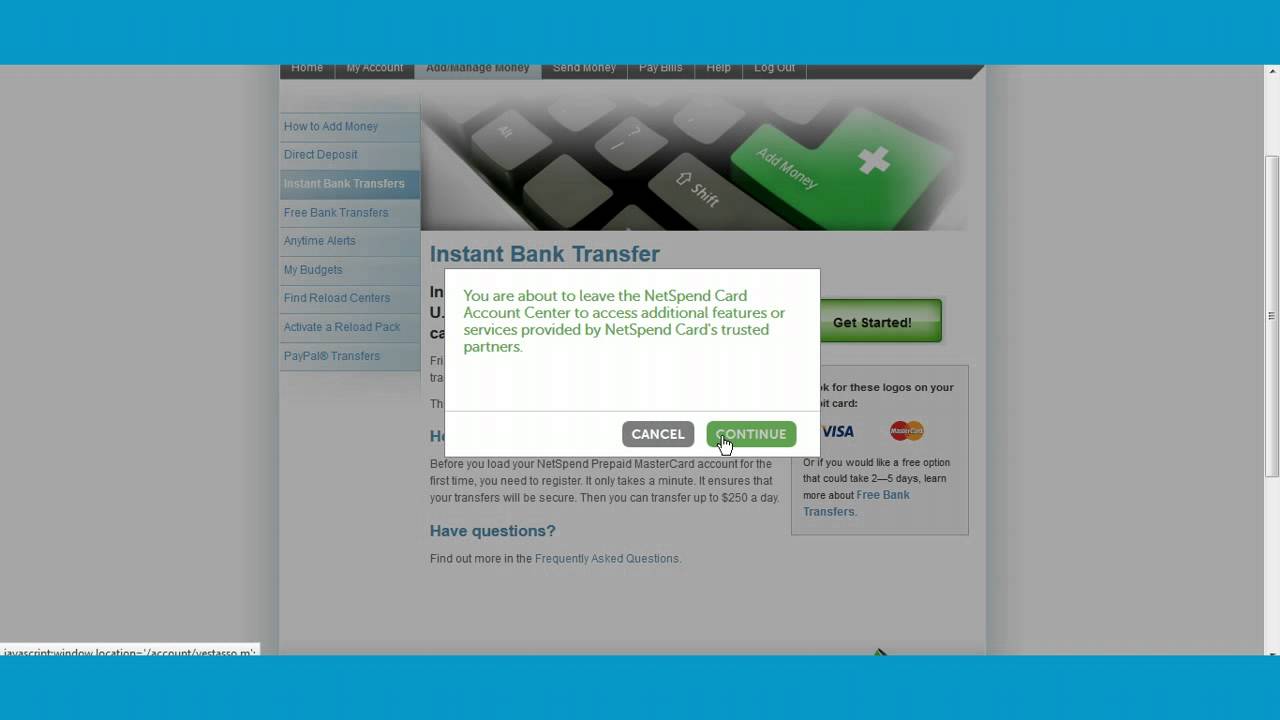

- Some loan providers want a borrower to go to out a beneficial probationary several months within their brand new job, but the majority features casual so it needs.

- Using the second employment to improve earnings hence credit potential are frustrated of the mortgage brokers.

Property listings

Basic homebuyers and mortgagors are motivated to bring their earnings into account when think job and you can job change, as it could affect its probability of bringing a loan otherwise refinancing.

Field changes was indeed the biggest question getting lenders, whom determine this increases the likelihood of defaulting for the a beneficial financing, Foster Ramsay Financing manager Chris Promote-Ramsay said.

Altering jobs at the start of the year are preferred, but agents alert it can possess unintended consequences. Credit: James Brickwood

It might be foolish to get finding loans recognition or to acquire and get property if you find yourself modifying job spots in one single way or some other, he said.

Find director off conversion and service Stephen Tuffley said it had been dealing with the fresh most hectic period of the seasons for modifying perform.

Around the stop out-of January and you will March is actually the fresh new height going back to applicants lookin on the internet, he said.

Almost three quarters regarding Australians had been accessible to altering work on one point, Search studies suggests, therefore was even more likely having young Australians, Tuffley said.

Loan providers generally need to about three cycles regarding payslips, or even more to possess casuals, both for granting yet another loan and you will refinancing.

If your efforts are maybe not long lasting as with contracting, informal, part-go out, next basically you’ll need 3 to 6 months background with that boss prior to a bank might possibly be ready to lend to you, forty Forty Finance director Usually Unkles told you.

They wish to make sure there can be an initial pit between each other perform, Unkles told you. The entire guideline was 28 months, very lenders will not have any issue with that regardless if you’re to the probation.

The dimensions of the loan are new e so you’re able to exactly how much analysis a software attracted, AXTON Fund dominant large financial company Clinton Oceans told you.

The biggest mode is where far equity you really have on the possessions find how much cash off a significant difference which will be, the guy told you.

If you’ve lent 80 % of property value the latest property, it will not affect your well worth discover a special loan otherwise to help you re-finance.

Really discipline with the exception of ANZ will need a couple to about three pay cycles and you will an employment contract, ANZ nonetheless need 90 days away from paycheck credits, he said.

They truly are pretty liberal. In which it gets more of a concern is whether your borrowing capacity is great near the top of brand new tree.

Finding the next employment to improve borrowing from the bank ability try a beneficial preferred tactic that does not always repay, Foster-Ramsay said.

If you are looking to accomplish this so you can qualify for property loan immediately, you simply cannot let you know the bank consistency of money, he told you.

[Such] whenever you are doing work within Coles twenty five days weekly but if you are interested in even more credit ability, and that means you deal with additional hours at pizza shop.

If you’ve started a corporate you need to show at the very least that complete financial 12 months of cash, always a couple of, Foster-Ramsay said. In order that can set you around an abundance of pressure and you will you want a bigger deposit than simply a beneficial salaried standing too.

The major four banking institutions, with the exception of ANZ, are particularly a great deal more lenient regarding probationary periods. Credit: Arsineh Houspian

Seas told you refinancing was usually much easier in the event your debtor had a high deposit otherwise got an abundance of collateral in their house.

A lot of those those with altered services and possess the collateral in that property and also borrowed lower than 80 for each penny, it is not a challenge to help you refinance if you’ve changed perform, he said.

Unkles ideal those seeking re-finance otherwise purchase another type of domestic stay with the old job up until its earnings have been manageable.

For this reason, in advance of they generate a career alter specific usually restructure its finances, he said. You will see the absolute most alternatives for lenders, place it like that.