Want to obtain a big local casino added bonus for little more than an excellent NZ1 deposit? This is your possibility to make the most of an unbelievable gambling enterprise strategy complete with a hundred Totally free Revolves to utilize to your common pokies which can be currently trending. Regular promotions contain the step new which have greeting packages, fits places and you will seasonal selling. However, understand the individuals conditions carefully – video game restrictions, wagering legislation and you can detachment hats can affect the wins big time. Support is essential, that is why i ensure casinos give a good twenty-four-hours service people. It indicates you could potentially contact the team any time that have concerns you have.

- Sweepstakes casinos may also are ‘Sweeps Gold coins,’ and that is collected and you may used for the money prizes.

- These offers tend to be deposit extra conditions, such as betting requirements and minimum places.

- Speed, shelter, and simple availability make all the difference on the betting experience.

- Your free chances are high exactly as powerful while the people repaid spin for this exciting second.

- Just remember the new wagering requirements – you will need to enjoy using your extra moments ahead of cashing out any victories.

For individuals who’ve produced a deposit from the a gambling establishment that is providing you with some free spins, you will needless to say turn your step one for the one thing more critical. To possess as little as step 1 you could potentially discuss a genuine money internet casino. You get around a hundred free spins on the Fortunium Gold otherwise another popular pokie.

Dracula slot machine – Professionals & disadvantages from 1 put gambling enterprises

Regarding security and safety, we know one Visa the most respected percentage actions around the world. The good news is for your requirements, all of the casino sites that we have about listing is fully acknowledged by the Charge commission, in order to easily deposit with Charge in the this type of 1 deposit gambling enterprises. NZ Gamblers is now able to delight in the day betting away without worries.

Lowest deposit bonus

For those who or an individual who you are aware features a gaming situation contact 100 percent free wagers aren’t in short supply while the gaming sites are continually fighting which have one another for your loyalty. Follow bookmakers’ on the websites and you can social networking avenues, or stay tuned to our playing development to save taking totally free bets. It can be used to try out an alternative betting approach, attempt to strike big otherwise build your money.

Other popular headings tend to be Novomatic’s Book away from Ra, Eyecon’s Fluffy Favourites, and you will Enjoy’letter Go’s History of Inactive. Your own step one put will most likely not last for particularly long at the a bona-fide-money gambling enterprise, so we suggest adhering to slots. Ziv Chen brings over 2 decades of expertise on the on line dracula slot machine local casino globe. A real world experienced, the guy aided profile progressive iGaming because of management jobs which have better operators. Now, the guy blends one insider training with a love of journalism, within the playing scene that have style. Off the clock, he or she is a satisfied Pitt graduate and diehard lover of everything Pittsburgh sporting events.

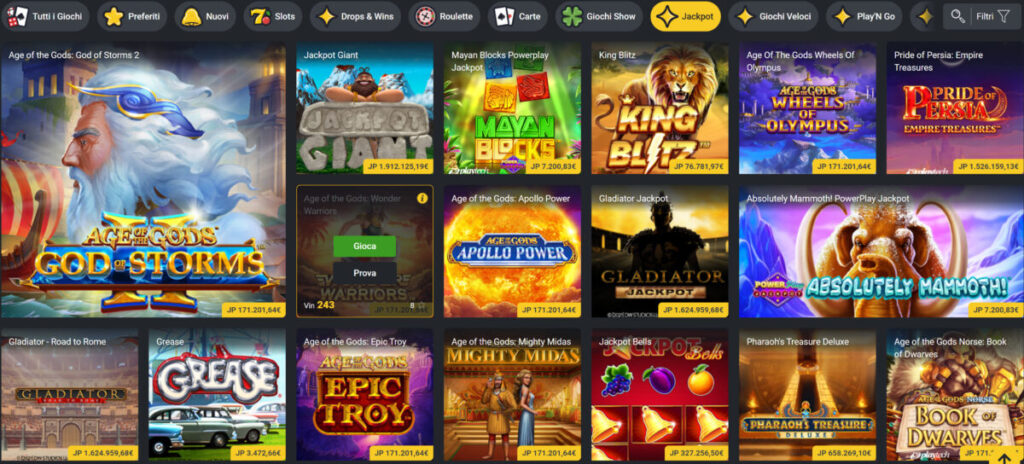

At the moment there have been two online casino internet sites inside the The brand new Zealand that provide your a hundred free revolves to the Fortunium Gold Mega Moolah a great step 1 put. Meaning it pokie is actually attached to the Mega Moolah Progressive jackpot. You can find out what kind of bonus and you can wagering specifications fits your needs. Naturally I’ve several favourite gambling enterprises inside the The newest Zealand that provide your one hundred totally free spins once you create a great step one put. A casino can be certainly my personal favorite gambling enterprises when it also provides a great added bonus, very good extra conditions and you may a good online game portfolio. Personally it is very important that consumer experience in the a gambling establishment is useful.

- Lowest deposit web sites can be found since the professionals will vary in the manner far they are prepared to deposit.

- When you order 100 100 percent free revolves for NZ1 you have got one hundred chances to result in the new jackpot controls and you can win among the available jackpots.

- If you would like take pleasure in real cash game on the move within the Canada, is actually 1 mobile casinos on the internet.

- In the casino games, the new ‘home boundary’ ‘s the popular identity representing the platform’s based-inside virtue.

Sure, of many gambling enterprises provide free spins with betting requirements as part of its invited or unique advertisements. Thankfully, the best step 1 dollars deposit local casino web sites render in control gambling products to trace and keep your own models. It is self-analysis inquiries, deposit or class limitations, and you will a personal-exemption otherwise cooling-of months. The sites also provide hyperlinks so you can elite communities like the In charge Gaming Council to own people experiencing situation betting.

Editor’s Possibilities: 20Bet – Best NZstep one Put Gambling enterprise for 170 Added bonus Spins and Greeting Bundle

To accomplish this, upload documents including driver’s license, passport, and you can electric bills. Those who love the old college to try out style can take advantage of some 3-reeled and 5-reeled ports. So it includes all the antique issues you expect such cherries, bells, 7s, bars, and you will horseshoes.

Away from Canada, Zodiac features managed to get in touch with people off their pieces around the globe as well, such as the All of us, European countries, and you will NZ. Zodiac Gambling establishment keeps a licence because of the Kahnawake Gambling Fee, a playing expert situated in Canada. Concurrently, this site is additionally eCOGRA official, to make certain arbitrary games results of casinos on the internet. I for this reason believe that this amazing site is both reputable and you may representative-amicable. Of numerous players try cuatro–5 other step 1 deposit gambling enterprises to claim several totally free spin also offers.

Just like Interac, Instadebit now offers instant places and withdrawals in this 1-step three business days. A commission of 1.95percent is billed, therefore it is a handy but slightly costlier choice for players. Introduced within the 2000, All the Slots Casino is among the longest-reputation casinos available to Canadian players. Belonging to Baytree (Alderney) Restricted and you will authorized from the Alderney Playing Control Percentage, the working platform has over twenty years of expertise in the iGaming industry.