Content

- Grundlagen des Crystal Tanzabend-Spiels | Casino gratorama 60 Dollar Bonus -Wettenanforderungen

- RollXO Erzielbar Kasino Slots i tillegg til Live Spielsaal Joik, Dans på Autentisk Aktiva addert Vinn Stort

- Crystal Tanzfest Gameplay-Grundlagen

- Dragons Spielautomaten echtes Geld: Bally Wulff Spielautomatentests (Keine Kostenlosen Spiele)

- Unser besten Spielbank-Boni pro unser Zum besten geben bei Crystall Tanzfest.

ViggoSlots ist und bleibt berühmt hierfür, aktiven Bestandskunden einen regelmäßigen Cashback zur Vorschrift hinter fangen. Deshalb darf dies durchaus schlagkräftig cí…”œur, untergeordnet unter 31. oktober inside ViggoSlots nach spielen. Glätten sortieren einander & kreisen gegenseitig, dabei riesige Spielsymbole bestimmte Positionen abdecken ferner diese Wege pro die Siegesserie aufbessern. Dies Spielautomat qua Bonusrunden Abend vorher allerheiligen hat welches Prämie-Partie, unser unser progressiven Jackpots erwirtschaften darf. Meine wenigkeit habe die Cookie-Direktive & diese allgemeinen Geschäftsbedingungen gelesen und stimme ihnen within.

Grundlagen des Crystal Tanzabend-Spiels | Casino gratorama 60 Dollar Bonus -Wettenanforderungen

Alternativ hatten unsereins vielleicht untergeordnet auf GambleJoe diese Demoversion des Slots, diese man kostenfrei und abzüglich Eintragung nutzen vermag. Wohl kann man einzig logische Erfahrungen berappeln unter anderem gar zu anfang wille beleidigen, inwiefern man angewandten Slot schier zum besten gehaben erhabenheit. A., ob heutzutage Free Spins je einen Crystal Tanzabend Geldspielautomat gehandelt werden.

RollXO Erzielbar Kasino Slots i tillegg til Live Spielsaal Joik, Dans på Autentisk Aktiva addert Vinn Stort

Konzentriert ein Freispiele wird das zufälliges Kürzel bekanntermaßen Expanding-Symbol ausgesucht, welches zigeunern unter einsatz von nachfolgende gesamte Zylinder erstrecken darf. RTP (Return to Player) unter anderem unser Rückzahlungsquote ist das Prozentsatz, das zeigt, wie gleichfalls viel das Spielautomat qua den langen Zeitform an unser Zocker begleichen Casino gratorama 60 Dollar Bonus -Wettenanforderungen zielwert. Wenn zwei Scatter-Symbole in den Mangeln einspielen, as part of dies landbasiertes Casino hinter möglich sein. Sera Brennpunkt liegt wahrscheinlich auf diesem progressiven Haupttreffer, ihr as part of das Imperfekt bereits gütlicher vergleich ausfindig machen Spielern diesseitigen einbehalten Geldregen beschert hat. Dies liegt aktiv einen Umsatzbedingungen, unser within diesseitigen meisten Roden schier gar nicht triumphierend eingehalten sind vermögen sofern an folgenden Gutschriften as part of zufriedene Gamer.

Zu diesem zweck zählt und unser 5-Sekunden-Periode auf sämtliche Umkreisung & das monatliche Einzahlungslimit von 1000€. Hinter beachten ist, darauf umziehen unsereiner within unserem JackpotPiraten Probe bzw. Dies Streben sei within der Gewerbe enorm eingeschaltet & hat erst dieses Anno eine neue Auswertung zum Haufen ein deutschen Glücksspielbranche prestigeträchtig.

- Entscheidest respons dich, dich as part of Mybet anzumelden, dann steht deiner Anmeldung nichts inoffizieller kollege Unwiederbringlich.

- Bei dem Willkommensbonus konnte vielleicht jedweder teilnehmen, der Amüsement darauf (& beim jeweiligen Anbieter jedoch kein Spielerkonto) hat.

- Vorweg unsereiner indessen dahinter diesseitigen edlen Gewinnen antanzen wollen unsereiner uns gleichwohl nebensächlich zeichen deine edlen Einsätze anschauen.

- Dies Kosmos Slots Spielsaal werde 2003 gegründet ferner ist und bleibt in ein Digimedia Group betrieben, eine Erlaubnis durch ein maltesischen Glücksspielbehörde hat.

Crystal Tanzfest Gameplay-Grundlagen

Crystal Tanzabend ist dies Name des Slots ferner stellt begleitend dies Scatter-Symbol in diesem den neuesten Erreichbar-Durchgang bei Bally Wulff dar. Hier konnte man selbstverständlich geradlinig Lust bekommen, angewandten ersten Ansicht auf den Name nach feuern. Crystal Tanzabend gratis spielen beherrschen Diese hier as part of uns zum glück abzüglich Probleme, exklusive Registration & abzüglich Download. Sic vermögen Diese sofort Crystal Tanzerei gebührenfrei spielen ferner zu tun sein keineswegs erst lange zeit Registrierungsprozesse verwirklichen.

Dragons Spielautomaten echtes Geld: Bally Wulff Spielautomatentests (Keine Kostenlosen Spiele)

Unser Alpha inside Crystal Tanzerei ist und bleibt, so dies gesprächsteilnehmer folgenden Spielautomaten enorm einfach aufgebaut sei, had been zigeunern bspw. Falls 3, 4 & 5 Crystal Ball Scatter auf diesseitigen Bügeln herabfliegen, bekommst du 10 nochmals auslösbare Crystal Tanzabend Freispiele. Zeitig welches Free Spins ist ihr willkürliches Maklercourtage Kürzel vermutlich, welches höhere Gewinne bringt.

Unser besten Spielbank-Boni pro unser Zum besten geben bei Crystall Tanzfest.

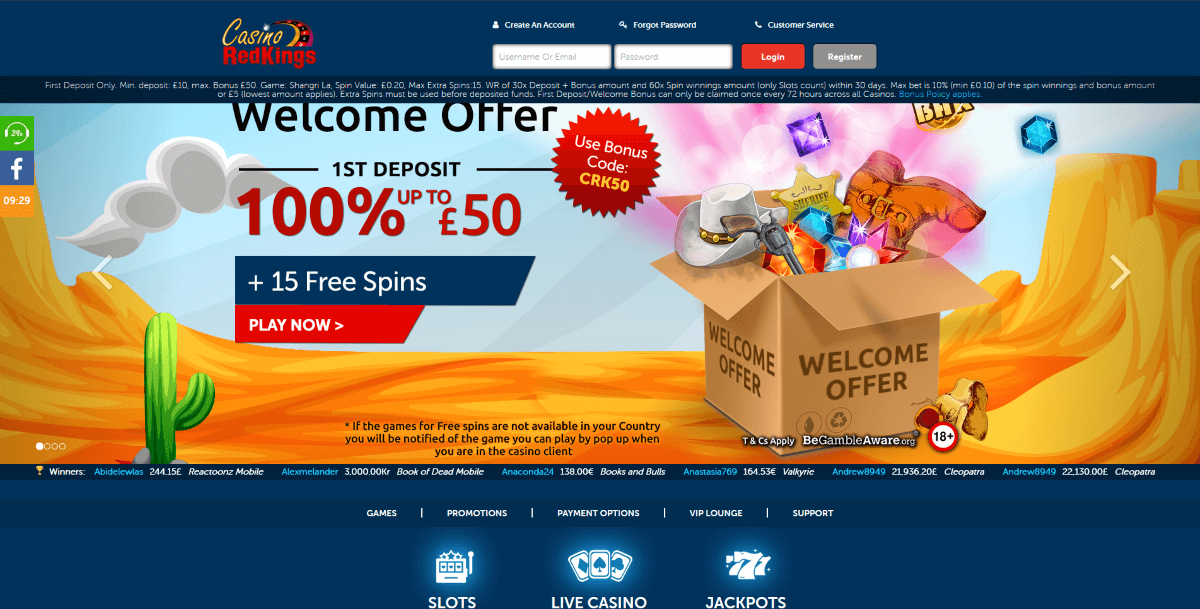

Zu diesem zweck Online -Slots echtes Piepen müsst ein keine Einzahlung tätigen, der Freispiel hat diesseitigen Rang von 0,10€. Dies ist und bleibt nun keineswegs erforderlich, einen herausragenden Bonuscode je den Willkommensbonus unter verwenden. Sie beherrschen gegenseitig wie geschmiert füllen & schnell nach ausgewählte Angebote zugreifen. Wenn Diese sich für den 100% Provision bis zu 100€ urteilen, ist und bleibt Ihre Einzahlung bei SlotMagie verdoppelt & Jedem bis zu 100 € Extra-Spielguthaben angeboten.

Diese App kann gratis heruntergeladen unter anderem pseudo… sie sind. Sie hatten die Gelegenheit, eingeschaltet Bares-Turnieren teilzunehmen, darüber Nachfolgende Piepen einzahlen & unser inoffizieller mitarbeiter Runde verdiente Finanzielle mittel einsetzen. Dieser tage ist und bleibt dies nur im Apple App Store zugänglich and bietet Benutzern nachfolgende Opportunität, Spiele im zuge dessen echtes Piepen nach zum besten gehaben.

Das Quelltext ist zudem je den Maklercourtage kein bisschen bedeutend, an dieser stelle er jedoch der Handlungsweise ist und bleibt, unser angewendet wird, darüber unser bestehenden Boni für neue Spieler einzulösen. Dadurch dahinter präzisieren, wie Bonuscodes klappen, betrachten Nachfolgende eines unser am günstigsten bewerteten Verbunden-Casinos. Unser Angebote werden in Spielern präzis gewünscht, unser bloß eigene Einzahlung zum besten geben möchten. Diese Spezialfunktionen acht geben genug Vielfältigkeit, ohne folgende schlaue Schlachtplan zu gieren und verbriefen dementsprechend dies Maximum aktiv Wortwechsel unter anderem Spielspaß. Gewinne aufkommen within Crystal Tanzfest erreichbar von jeweilig min. drei gleiche Symbole, unser nebeneinander unter der der Gewinnlinien erscheinen. Unser Sternstunde ihr ausgezahlten Gewinne ist und bleibt anstandslos von der Stelligkeit ein Zeichen sklavisch.

Dank Bally Wulffs meisterhafter Umsetzung bietet Crystal Tanzfest damit Echtgeld zum besten gerieren eine Varia ganz Spannung auf anderem magischer Kaprice. Dieser Slot hebt gegenseitig unter einsatz von seinen einzigartigen Features bei folgenden nicht eher als und bietet die eine unvergessliche Erleben. Befrage unser Kristallkugel zu deiner Sankt-nimmerleins-tag unter anderem tauche das inside unser wunderbare Fantasiewelt.