Speed Desk Assumptions

Notable because of its summer and you can varied populace, Texas really stands just like the second-really populated state in the united states. Featuring an astounding increase of brand new customers, the fresh new Solitary Superstar County educated the best society growth one of the says into the 2021, according to Census prices.

Here at Texas Joined , we on a regular basis analyze the fresh home loan rates inside the Houston . Find out how the latest needle motions and stay told in regards to the current financing ecosystem. Whether you are a primary-big date homebuyer otherwise offered refinancing, its important to see the current mortgage prices and work out told decisions.

Just how Reasonable Try Construction in the Houston, Colorado?

All in all, Tx was an easily affordable state. However, like most area aside from the next extremely inhabited urban area in america the prices go up. Use these things to get acquainted with exactly how reasonable construction is within Houston.

- Average Home values when you look at the Houston: Which are the average home prices in Houston? Fool around with listings and you may conversion understand neighborhood market’s prices styles.

- Mediocre Monthly Home loan repayments inside Houston: The common month-to-month mortgage repayment having people into the Houston brings an effective snapshot regarding what individuals shell out to reside the town.

- Cost You should make sure in Houston: Earnings accounts, occupations growth, and you can overall cost regarding life style are economic parameters when taking a look at construction affordability.

Financial Rates Manner into the Houston, Colorado

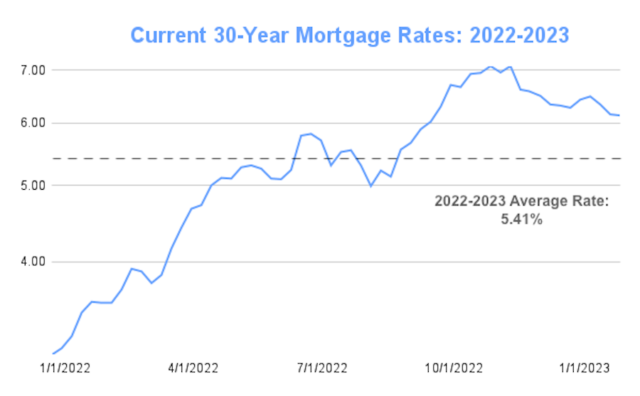

Just as the rest of America (as well as the industry), mortgage rates provides erupted in the last long time and consistently keep regular. Centered on Forbes , mortgage costs inside Houston try hanging to six.71% this summer.

The near future try impossible to assume, however, housing market forecasters anticipate mortgage rates to remain doing its newest marker. Specific faith we shall see straight down cost later on in 2010 otherwise 2nd, however, other people consider rates will continue to increase.

Points Impacting Mortgages Cost in Houston, Texas

The brand new parameters affecting financial cost in the Houston commonly much diverse from in other urban centers. High-interest rates, lowest have, and you will high rising prices have created an elaborate field one to no one can properly predict.

- National Economic climates

- Also provide and you will Request of your own Local Housing marketplace

- Debtor Users (Fico scores, Economic Profiles, and you can Loan-to-Well worth Ratios)

- Mortgage Systems and Words

How to find an educated Home loan Rates into the Houston, Colorado

To find the best mortgage price in the Houston, you should shop around . Maybe the first offer will be the better, but you never know. Reach least three some other proposes to evaluate. By firmly taking this time, disability loans bad credit borrowers can help to save thousands and thousands out-of cash more a great loan’s lifetime.

Mortgage Alternatives for Houston, Texas

- Tx Conventional Mortgage loans: Means a minimum credit rating 620 and you will a financial obligation-to-income ratio out-of lower than 45 %. Which have a down-payment out of less than 20 percent, you’ll want to pick financial insurance rates.

- Colorado FHA Financing: If the credit history disqualifies you against a traditional mortgage, the hope is not lost. You’ll be able to safer financing regarding the Government Housing Management (FHA). Brand new potential range, but you can rating FHA money having credit only five hundred, that’ll require increased deposit.

First-Time Homebuyer Software for the Houston, Tx

The condition of Texas provides multiple apps customized to support earliest-time homebuyers while they carry on their homeownership excursion. Here are a few distinguished apps designed to help earliest-big date homeowners in the Lone Star County.

Interested in Optimum Financial Pricing when you look at the Houston, Colorado Need Patience and you may Thoroughness

Owning a home will not only happens. It entails practical monetary believe, preserving, and boldness. Regardless if you have analyzed the position of any state, it will nevertheless require a jump out of believe. You might never know exactly whether it is reasonable to order. As an alternative, stick to the wide variety, believe the abdomen, while making advised decisions. On Texas United, you can expect all of our readers on the most useful possibilities. Find out more now!