Content

From our sense, really 20 free revolves no-deposit bonuses do include wagering standards affixed. These criteria should be fulfilled before you could withdraw people profits produced from using your 100 percent free revolves. Such, if you have 30x wagering requirements for the 20 100 percent free revolves, you should bet people winnings out of your no-deposit extra 29 times before you can cash out.

However, totally free revolves local casino works together with zero betting conditions indicate just that – you can turn the newest payouts to your actual cash rather than undertaking one thing. 21 Casino offers the new participants an alternative greeting incentive away from 121% as much as £one hundred to their very first put. Bonus money try independent away from bucks financing and therefore are susceptible to a great 35x betting specifications, with just added bonus money adding to it needs. Normally, 100 percent free spins are given so you can encourage the brand new participants to register otherwise as the a component of a pleasant bundle. Most often, online casinos render regarding the 20 100 percent free spins, however some offers could possibly offer as much as 50 100 percent free revolves as an element of a stylish welcome bonus. MrQ Casino has free spins coupons you to unlock 5 100 percent free spins for the fan-favourite slot online game, Starburst, with no put needed.

For simple gambling enterprise bonuses, the new betting specifications is attached to the incentive amount. A good example is a good 20x betting requirement for an excellent $10 no-deposit added bonus. This means you’ll have to wager 20 x $10 (incentive amount) before you can cash out, which may getting $2 hundred as a whole. No, you wear’t you want a plus password to help you discover the fresh Totally free Spins added bonus to your Casino.com. The newest participants can get the brand new no-deposit 100 percent free Spins after subscription.

Aloha Cluster Pays slot | Best Free Revolves Casinos inside the july 2025

You could see an excellent shock waiting for you in your local casino account otherwise found another current email address with original now offers customized especially for the birthday celebration. Understand that a lot of Aloha Cluster Pays slot reload incentives manage feature betting criteria affixed. Hence, it is vital that you thoroughly realize and see the gambling establishment bonus small print prior to choosing to the people reload incentive. Here are all Top 10 a week 100 percent free revolves bonuses considering at the best web based casinos. Such, BitStarz Local casino also offers a pleasant incentive for the the brand new people’ earliest four deposits on the website.

To engage the deal, participants have to put at least £10 utilizing the added bonus code GAMBLIZARD. No deposit subscribe bonus for brand new British people from 25 free spins on the popular position Guide away from Dead. So it campaign can be found in order to people who’re recently registered and you will get done the fresh verification procedure.

What exactly are No deposit 100 percent free Revolves?

Although not, when you fatigue all of the free revolves, you ought to lay a wager to continue to experience. At the EnergyCasino, we personalize all the Greeting Extra for the demands of our players, so we for example modifying one thing upwards periodically. As a result, dependent on your own jurisdiction, you may also see some other campaigns and benefits. There is absolutely no put required to participate in gambling establishment tournaments, however may have to lay a minimum choice and you can play thanks to loads of spins in order to qualify for the newest leaderboard. Its not all game contributes an identical on the wagering standards. No deposit borrowing from the bank incentives be flexible inside their terminology than just free spins because you can decide and this game you would like to test her or him on.

The fresh Position Internet sites

The best free revolves casinos noted on BonusFinder You try controlled because of the county betting profits and you will obviously pay all totally free spins payouts so you can people. Just be sure that you done it is possible to bonus betting standards said in the added bonus words. Free spins usually feature 1x wagering standards, definition you’re able to cash-out payouts once you’ve starred them immediately after.

Best Gambling games with Free Spins Bonuses

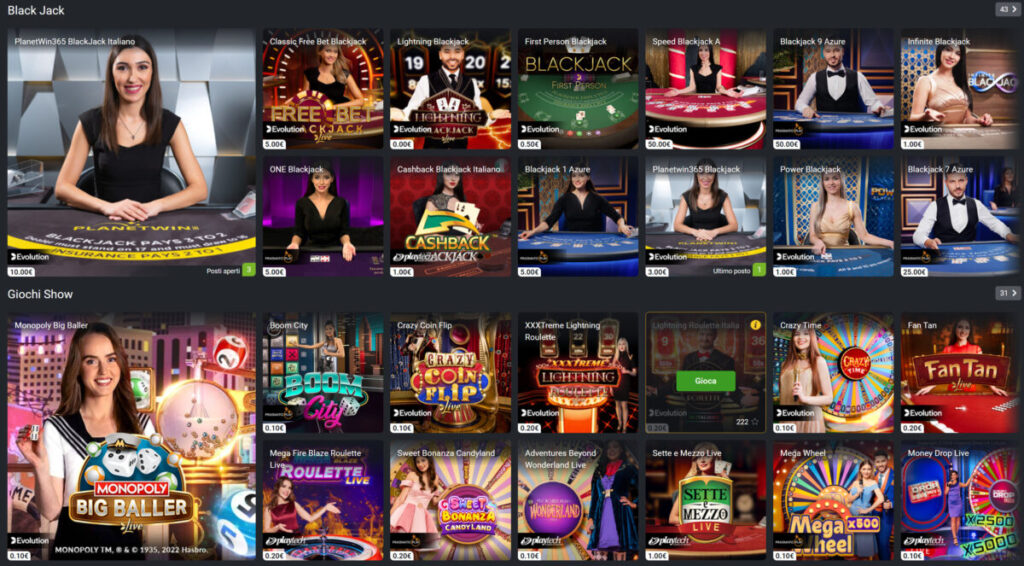

Among those reasons would be the substantial, step 1,000+ harbors plus the each day McJackpot free spins which can web your as much as 200,000,one hundred thousand GC otherwise 100,100000 Sc. The new 16 alive casino games are a great time playing with real time chat for the. Inspire Vegas Local casino seeks to have a immersive public playing feel round the their 700+ ports and bingo game. Your won’t discover a huge amount of game organization however, there are some jewels including Pragmatic Play’s Larger Trout series. On top of the step 1.75 million complete Inspire gold coins offered while the incentives, Impress Las vegas also has a wide range of money packages to obtain $step 1.99 up, as well as constant award drops.

View specific advertisements for information and make sure your investigate fine print. Yes, although not, you might be required to help you up coming register with the brand new chosen gaming site. Once we said above, you could view our very own considering organization and their tasty incentive spins. Find any, after which, you’ll check in there by the claiming the zero betting 20 extra revolves. Video game such as Starburst and you may Gonzo’s Journey are apparently searched, offering fun game play as well as the opportunity to win real cash online game. Expiration times are various other important name to look out for whenever stating 20 totally free revolves.

You can use totally free revolves also offers from the numerous U.S. casinos to check on the water and discover how gambling enterprise works before you make a big put. Some casinos cover what kind of cash you might victory having fun with 100 percent free revolves. Including, you can even simply be able to 100x otherwise step 1,000x your own 100 percent free spin choice. Discusses has been a reliable supply of managed, subscribed, and you can courtroom gambling on line information while the 1995.

Professionals is claim free no-put spins to your qualified game as part of a good cashback plan or in continual free revolves product sales. Any bonus perhaps not utilized would be forfeited at the conclusion of the 3rd go out. Ports LV try a well known on-line casino that provides attractive zero put 100 percent free spins incentives. This type of advertisements enable it to be participants in order to earn real money rather than to make an enthusiastic 1st put, and make Ports LV popular certainly one of of numerous online casino followers. Participants may use the totally free revolves on the a diverse number of popular position online game offered at Slots LV. Free-twist winnings and you can added bonus borrowing acquired due to local casino incentives are often subject to wagering criteria, that could apply to the newest deposit matter too.

Once you sign in, you’ll discovered a fixed amount of free spins no funding on your own avoid. However, a good promo password was expected to activate the brand new totally free revolves extra, very watch out for those individuals. Lemon Gambling enterprise provides 20 no-deposit 100 percent free revolves only to the brand new Canadian professionals, that can be used on the preferred slot online game, Huge Trout Bonanza.

You’ll want to play have a tendency to and you can proceed with the social networking channels for situations so you can take advantage of these types of totally free revolves. They only arrive during the inside-games events, such as whenever fulfilling players whom raid otherwise battle most other players. After you’ve welcome all family and they have joined, both you and your family can also be gift both Money Learn totally free spins and coins everyday! Our very own Money Grasp extra links have the current Money Learn 100 percent free spins and you will gold coins and are totally safe and examined to operate just before getting added! Make sure to look at our very own Money Learn tips and tricks, Coin Master incidents, and you can Coin Grasp chests courses to optimize the performance regarding the online game. The only method to utilize the hyperlinks a lot more than should be to install the newest Coin Professionals application to the Android and ios.

Planet Sport Wager Casino now offers fifty zero betting free spins on the Practical Play’s Huge Trout Bonanza. Casushi are a dependable Japanese/sushi-motivated website that provides more than step 1,250 online game, high Uk customer care, and you may instant/free withdrawals. Finding the optimum no-wagering position offers is not difficult but day-intense. Our very own industrial director, Sam Darkens, liaises everyday that have couples to collect the fresh also offers to have OLBG customers.

These types of email also offers 100percent free revolves are an easy way to possess players to play the newest video game instead risking their particular money. It gives him or her the ability to talk about some other harbors and find out the brand new favorites. In addition to, one winnings from these free revolves usually can end up being converted into added bonus financing which can be used to experience far more online game and you can probably earn a real income. To get into these exclusive totally free revolves also provides, participants can also be create the new gambling establishment’s current email address newsletter. Because of the subscribing, participants can be sit informed in regards to the newest offers and you may found normal status on the the brand new online game, put incentives, or any other exclusive now offers. 100 percent free spins also provide professionals on the chance to victory actual currency.

Particular bonuses are certain to get steep rollover requirements, while other people might possibly be slightly big and you can impose no betting at the all. We analyse all of the local casino sites to ensure they are registered inside the Great britain and put away the ones that feature 50 spins no deposit also provides. Score a great one hundred% added bonus to £50 and 50 free spins to the Guide away from Dead to your promo code. To increase possible productivity, believe calculating the perfect level of spins or gaming brands aimed with your approach, because the no betting makes it possible for quick profits.

You could potentially turn on that it render from the some other gambling enterprises because of the deposit $twenty-five or higher. Because of the Increasing Reels ability, this really is among the best games to make use of free revolves to your. In the totally free revolves bullet, reels can also be expand in order to twelve rows large, carrying out to 248,832 effective indicates.

Our personal favorite ‘s the Super Moolah position – an excellent cuatro-jackpot progressive position game, Super Moolah achieved the newest term away from “Billionaire Inventor”. Their honours are among the high in the industry and also the game play is quite enjoyable and immersive. Created by Microgaming inside the 2006, the fresh slot received a good Safari motif and lots of features to save players interested.