Blogs

One to significant benefit of online slots games is the capability to play 100percent free. Unlike house-founded gambling enterprises, online websites aren’t restricted to floor space—so they enable you to try video game for free. Test out popular titles such as Light Orchid, Cleopatra, and you can Glaring X, or mention step three-reel classics and feature-steeped video clips ports as opposed to investing a dime. As opposed to regular incentive cash, no wagering gambling enterprise bonuses don’t include chain affixed.

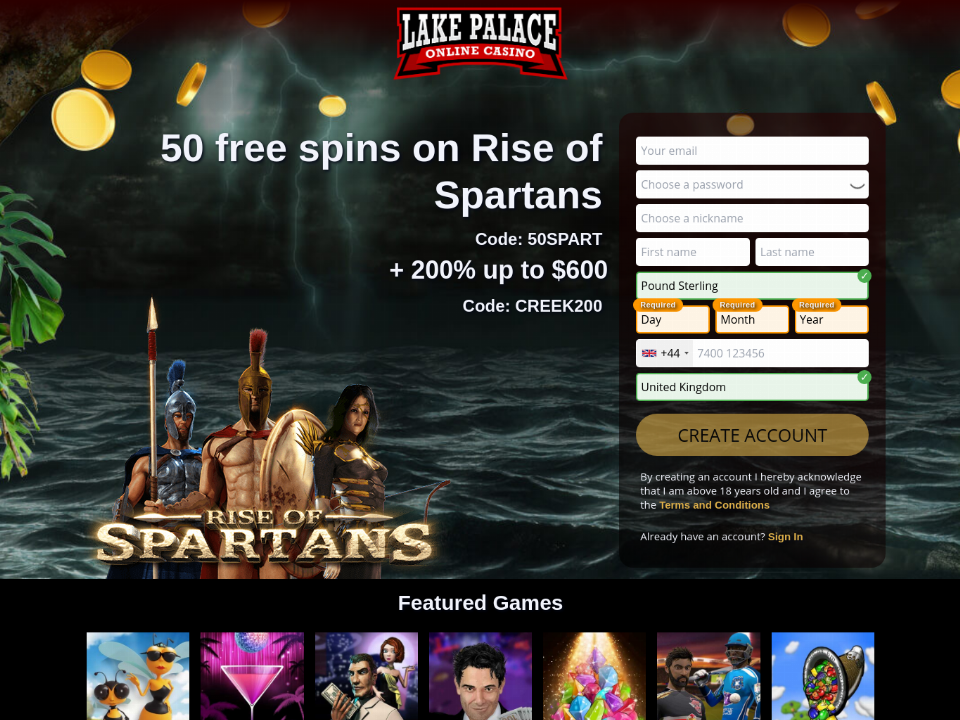

Added bonus password: LCB20 | slot fortunes of sparta

- For the people curious about the evaluation procedure, we’ve said the way we selected the top on-line casino incentives and you will why it obtained the new relevant score.

- Oddsseeker.com and all content herein is supposed for visitors 21 and you may more mature.

- We’ll in addition to highlight one free revolves, extra cycles, wilds, or other unique icons since these sign up for the brand new commission possible.

- No-deposit incentives will come in the way of bonus spins, gambling establishment credit, reward issues, bonus potato chips, a fixed-bucks bonus, otherwise sweepstakes gambling enterprise incentives.

- The fresh designers out of Gambino Harbors features constructed a person-friendly software which have fantastic graphics.

- Hear about these types of requirements regarding the small print and make sure you know them before continuing.

Put slot fortunes of sparta incentive spins create wanted a purchase in order to stimulate the brand new 100 percent free spins bonus. Although not, check out the fine print for your free spins render one you find. Extent might not be greatly, and if you were already thinking about placing anyhow, there’s no reason at all not to make use. You are able to win significant quantities of money, honours, and other benefits that have free spins.

Free online harbors try electronic slot machines that you can play instead of wagering real cash. Such video game supply the same features, picture, and you may gameplay as their real-money equivalents however, play with virtual credits unlike dollars. Participants can enjoy endless spins, discuss incentive features, and you can possess adventure from slots with no monetary exposure. Perhaps an informed local casino extra you should buy ‘s the no betting give.

These types of benefits bring of numerous shapes, but generally, it don’t need the pro and then make a deposit. Sign on incentives are very enticing as a result of its ease and you can convenience from access, requiring limited associate energy. Games including Firearms Letter’Flowers, Blood Suckers 2, and Dazzle Me personally all the has RTPs from 96% or even more. Speaking of extremely common since the, technically, they supply a better danger of successful through the years. Talk about our very own listing of finest-rated totally free spins bonuses and you can claim your favorite incentive!

Exactly how we Get the Better Online casino Incentives

- Exceptions are present where bonuses you’ll target desk video game or live specialist video game.

- Which slot shines for the advanced construction and interesting game play.

- A distinguished disadvantage from Gambino Slots ‘s the prevalence away from pop music-ups, that is intrusive and you can disruptive.

- Join along with your Myspace account to determine what members of the family is also posting otherwise discover merchandise.

- Online game assortment is crucial whenever ranks an on-line casino, so we look at the amount of software team found on for each platform.

When you have a certain online slot machine game you want to gamble, be sure to makes it perhaps not excluded from the campaign. The finest casinos on the internet give nice incentives for the brand new and you will current participants. Slot incentives is going to be section of a good method to earn on the online slots games. Get the best on-line casino added bonus now offers from 2025 here. Whether you’lso are fresh to web based casinos otherwise an experienced player, this article will show you the major incentives, simple tips to claim her or him, and you can suggestions to take advantage of from the gambling feel. Online casinos usually render the fresh ports to find people to try him or her and construct dominance.

RTP is paramount figure to own harbors, functioning opposite the house line and you may showing the potential benefits so you can professionals. RTP, or Come back to User, is actually a share that displays simply how much a slot is anticipated to spend back into people over several years. It’s computed based on many otherwise huge amounts of spins, and so the percent try direct ultimately, not in a single training.

With this particular, you get a different opportunity to do a lot more winning combos. You do but not discover very totally free slot machines instead of downloading otherwise registration of any kind. In reality the entire section of demo gamble is always to come across just what games are supplied at the different brands before at some point deciding which site you want to enjoy in the the real deal.

Including, an excellent €step one, % matched offer usually double the put, up to a maximum of €1,one hundred thousand. Matched deposits are a great way to improve your own bankroll to the your own very first deposit, with quite a few gambling enterprises giving one hundred% deposit suits or even more. Max choice refers to the largest unmarried bet you could put when using extra money.

This site contains a large number of trial position headings you might gamble completely 100percent free. Thanks to the broad possibilities, along with our advanced filtering and sorting system, you’ll likely find what you’re looking for. Which thrilling online game invites participants to see the new money away from an excellent destroyed civilization. As the gather item are receive, the brand new bullet continues to the final number out of totally free spins granted. Throughout the this particular aspect, 40 winlines try productive, and also the class begins with a good 1x earn multiplier. Unwrap the newest present of limitless 100 percent free spins when you belongings cuatro or even more scatter icons, causing a joyful ten totally free revolves.

How to choose a knowledgeable Online Slots to the Down load?

As well as in the-games totally free spins, you could increase effective potential if you take full benefit of casino 100 percent free spin incentives. Here are the sort of campaigns there is certainly to possess harbors which have 100 percent free spin rounds. While the brand-new development-setter, Microgaming is hard to conquer to possess modern jackpot auto mechanics, which can be won inside the bonus series.

The girl commitment to doing direct posts has created the woman since the an excellent trusted writer from the online gambling blogs world. Practical Enjoy’s Wolf Silver is another preferred possibilities if you are looking to possess on the internet pokies totally free revolves no deposit possibilities to boost your probability of successful big. It’s a fantastic bonus bullet and you may a no cost twist ability and therefore causes usually. It also boasts step three modern jackpots regarding extra piece of thrill. While some 100 percent free revolves will most likely not want a deposit in order to allege them, you may need to put before you withdraw their winnings from the new free spins casino.

Common harbors is around three otherwise four reels, but some provide more, in addition to all the the newest harbors on the the listing. NetEnt could offer excellent songs-graphic experience in its ports, and for the common Divine Chance progressive jackpot slot as well as the antique Jack Hammer position. The new NetEnt ports, including Jack Hammer step 3 and Fury, has trapped on the highest-top quality presentation. IGT the most common app company, offering classic games including Cleopatra and you can Wolf Work with.

Just what are position incentive games?

Including, a grams-Money bundle are given to have $0.99 in this review. Log on together with your Fb account to determine what family is send otherwise found gift ideas. Totally free to you – you’ll receive the credit just for performing another local casino account.