If it’s merely higher odds you are after then Redbet should not become your https://maxforceracing.com/formula-e/new-york-city-e-prix/ very first port from label. Although not, he’s got some very nice now offers and you can advertisements which usually work at combo-wagers and will help push-up the odds a tiny. On their website they supply odds-on a large number of suits and you can places. The choice boasts both big leagues and the smaller of these too deals in terms of the top fits and you can situations. The selection of possibility is good, and because the newest relocate to Kambi, is right up indeed there to your better betting internet sites in lot of respects. The brand new leading provider to possess Redbet is sports, in which they give a number of wagers.

Software

Finally, head office features safeguarded another articles partnership with Play’n Wade which can provide a lot more assortment for the gaming web site. All in all, RedBet get some of the most positive reviews i’ve viewed. It’s obvious the new gambling enterprise is recognized as really reliable and expert at the investing participants the winnings promptly. Naturally, almost always there is area to own upgrade as well as RedBet they’s its VIP system and you will video poker collection you to definitely still you desire functions. However, RedBet will come highly recommended in the most common gambling establishment recommendations. To the disadvantage, here isn’t the new thorough list of deposit steps which you’ll come across at the particular online casinos.

Demanded Internet casino Bonuses

Such, you could wager as much as £3 hundred,one hundred thousand to the roulette and up to £ten,one hundred thousand on the blackjack. Baccarat and you may Fantasy Catcher are a good options for players that have severe bankroll. Having sixty alive specialist game, partners online casinos rival RedBet when it comes to possibilities. The brand new alive dining table lounge away from Evolution Gambling are an exceptionally an excellent fit for black-jack participants. Yet not, roulette and baccarat participants will even find generous alternatives. There’s a significant set of low restrict and you will large limit tables readily available.

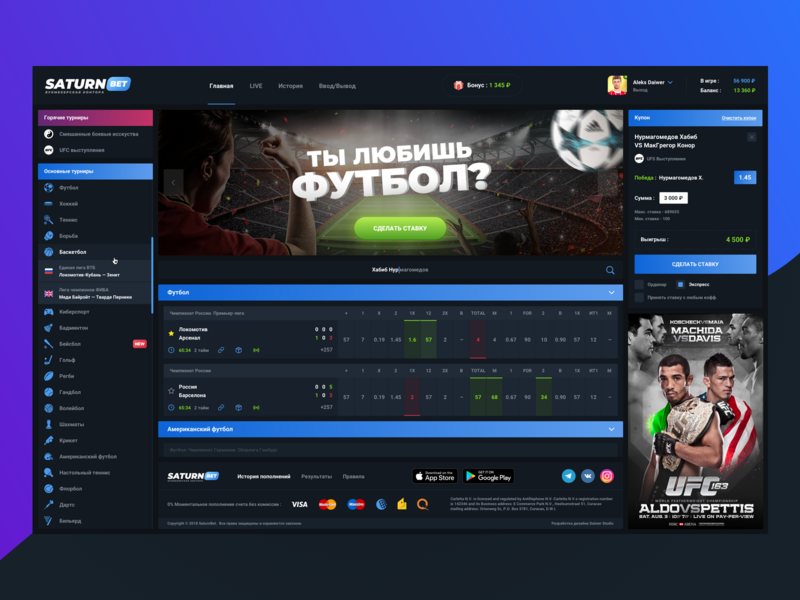

At this time, it offers an excellent band of activities odds, gambling establishment and poker. Although bettors has welcomed the new on the web fee choices, there are many just who nonetheless hold onto traditional banking. Although this manage typically become inadequate, progressive financial functions have reached a point where they could opponent a few of the introduce-day electronic percentage choices.

Redbet Welcome provide

Other preferred leagues range from the NCAAB, France’s LNB Professional, and The country of spain’s LEB Oro and ACB, and others. Sports is one of well-known sport so you can bet on at the Redbet and you may realize that so it sportsbook helps all the big Western european and around the world leagues. More particularly, you might set bets for the German Bundesliga, the netherlands’ Eerste Divisie, the brand new Language Los angeles Liga, England’s Biggest Leagues, and you may dozens a lot more. You can find always effective activities leagues, giving you the ability to set wagers during the at any time of the year.

Business government assures RedBet’s pc and cellular website is shielded which have SSL technology. So it obscures the website visitors delivered anywhere between customers plus the gambling establishment. Including the brand new encoding of personal information and you will financial purchases. You’ll find the detachment steps are practically just like the new noted put choices, apart from Paysafecards.

Plus it requires but a few ticks making their forecasts, making certain you spend no time once you’re also middle-matches. The new RedBet gambling establishment reception is stuffed with video game in the greatest brands in the industry. Simultaneously, you’ll find dining table game out of NetEnt and you can a thorough live agent couch from Development Playing. Redbet render many ways and you may campaigns which their users usually takes area in the. These types of offers security a wide spectrum of chance, local casino, and you can poker. These can were old-fashioned venture versions, such enhanced opportunity, cashback otherwise free wagers.

Come across Help towards the bottom correct-give area of your website and Live Chat to release their on the web talk assistance. We could not blame RedBet when it comes to its app people. All guarantee the gaming program properties more reducing-edge headings having superior quality image and you may voice. Arthur worked for some other companies both to your operator top and you can the brand new vendor side. Now Arthur are consulting expert who along with wants to enjoy and you will build gaming example channels. Arthur Clarke provides achieved lots of knowledge of Playing throughout the their existence.

This means the new gambling enterprise doesn’t upload information on its some other VIP membership and you will respect things criteria. This can be an embarrassment as we such as all of our clients to learn just how many comp issues are expected for each and every cheer. Alternatively, people during the RedBet casino simply have to deposit, enjoy, and you will promise one to a great VIP manager are at out over her or him. At this latest day, Redbet don’t possess an application within their giving however it’s named in the pipeline so we’lso are remaining our very own eyes peeled to own if it falls.